7 Reasons Why You Should Understand Your Cash Cycle

You often hear throw away comments such as “Cash is King” and “Cash is the lifeblood of business” – but what do these really mean?

“Cash is literally King” – as it is arguably the most important aspect of the financial health of any business and essentially “rules” over what happens. The other fitting analogy is that “Cash is the lifeblood of business” – as a business without cash will close just surely as a body without blood will die.

When I look at a business, the second statement normally resonates more for me – as an important component of cash is that it has “fluid movement”. Cash in a business is forever moving; in from sales, out to suppliers, in from debtors, out to wages etc. Thus it is the speed, duration and path of this cash which becomes of great importance.

Cash literally cycles around a healthy business.

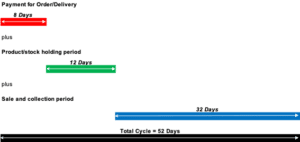

Now consider for a moment the term “cash cycle“. For the purposes of this article, cash cycle means the cycle time from spending a $ to raise/prepare a product for sale all the way through its sale to the eventual receipt of payment.

A simple example of this is:

Day 1. Spend money to acquire stock

Day 5. Stock is received into store

Day 8. Stock is made available for sale

Day 20. Stock is sold

Day 22. Stock is delivered to the client and an invoice issued

Day 52. Payment is received from the client in full payment

In this example – the products cash cycle is 52 days.

Understanding the basic principle, you can then appreciate that every business is likely to have a different cycle – with the complexity increasing once you start considering; raw material purchases, manufacturing times, international trade purchasing and sales, extended shipping, early payment discounts, deposits and financing – just to name a few.

Another way to quickly explain this is using the following diagram:

Basic Cash Cycle – no payment terms

So with an understanding of what a cash cycle is, the purpose of this article is to challenge whether you know your cash cycle? Do you know it? Do you frequently measure it? Do you know what it’s costing you?

Once you understand your cash cycle – you can then take advantage of the following benefits;

- You can calculate the amount of “cash” that you have tied up at any one time, which in turn means that you can also calculate how much more you need for growth.

- By understanding the different time points in the cycle, you can start to identify where time savings can be made and how much this will save.

- By knowing the amount of cash tied up in your cycle, you can calculate the carrying cost of this – either funded by an overdraft/debt or by an equity investment.

- Understanding the cost of your cash will enable you to factor this into your pricing mechanism, thus making it far more accurate.

- Knowing all of the above points mean that you can accurately calculate the benefits to your business of offering OR availing of early payment discounts.

- Understanding and recording the cash values and cycle timings mean that you can more accurately prepare cashflow forecasts to predict where you are going and what volume of cash you will need to get there – and….when you will need it.

- Having a “mindset” of knowing how your cycle is compiled means that when sale or discount opportunities come up – you can quickly assess the benefits and viability to your business.

The most successful businesses that I have dealt with have had an intimate knowledge of their cash – its cycle, its costs, where it’s used and how much they need in the future to fund their operations.

As an important step towards this point, stand back and assess your cash cycle so you know with confidence what it is and then….apply this knowledge into your day to day business decisions of purchasing, sales, pricing etc. You will be amazed at the additional value you will be able to create by pumping the business lifeblood of cash, just a little bit harder.